The contours of the stunning India-US trade deal are yet to emerge. It is the same with the India-EU Free Trade Agreement signed a day after the Republic Day parade. What is clear, however, is that the two FTAs represent India’s renewed drive to lure FDI in order to prepare itself for a world driven by hard power, both economic and military. In the Trumpian world, populated by hard power devotees like Valdimir Putin, Xi Jinping and Erdogan, its absence reduces diplomacy, the main instrument for resolving sticky issues, to a mere sideshow.

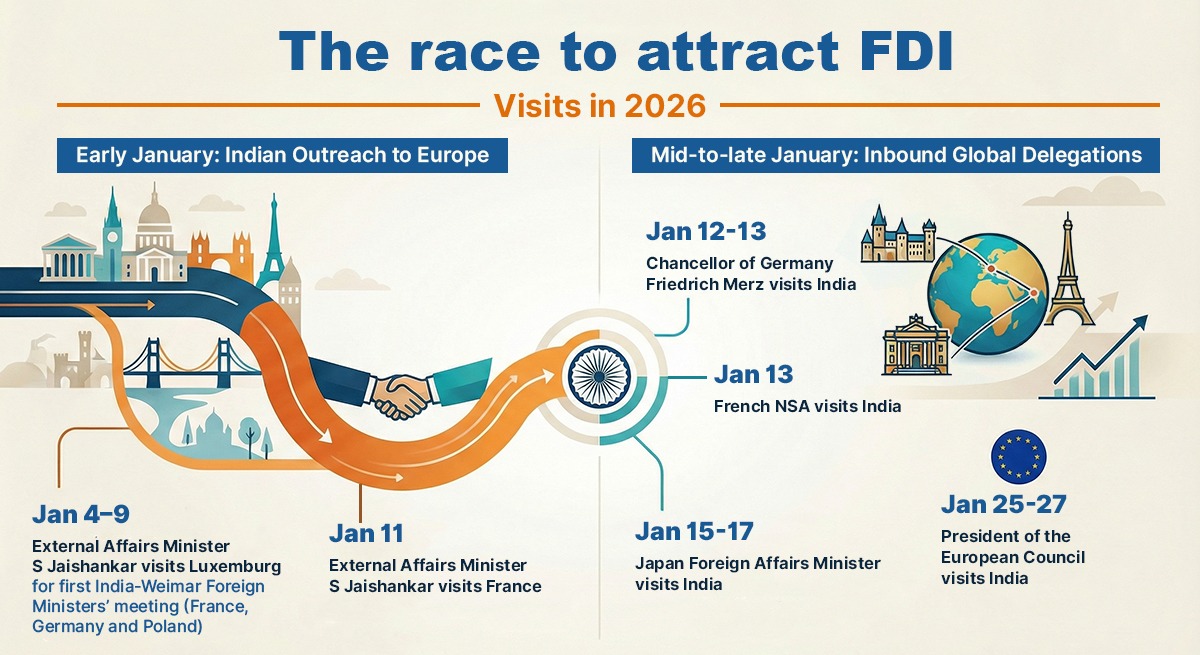

For the past two months, there is a clearly visible trend of Indian leaders going to countries that are sources of FDI and high technology or of leaders from such countries making Delhi their favoured destination.

The political underpinning for this drive is the realisation that the doors of migration to countries with higher FDI than India have virtually closed compared to the welcoming environment of about a decade ago. Most of the FTAs signed by India have a provision for skilled migration but it is anyone’s guess about the actual outcome.

As more and more youth enter the job market and as western doors remain shut to migration, policy makers in South Block are now redoubling efforts to seek foreign investment and technology as a means to provide employment, build infrastructure and boost exports.

Amidst the flurry of foreign political leaders over the past one month, the visit by Spanish Foreign Minister José Manuel Albares stood out. More than any documents signed, his arrival vindicated India’s resolve to take on China. Last year, it was Madrid which saved the Beijing’s FDI bacon. In 2024, China recorded FDI inflows of just $ 115 billion, down 27.1 percent year-on-year. If it was not for Spain increasing its FDI to China by 130 per cent, India and China would have recorded near similar figures.

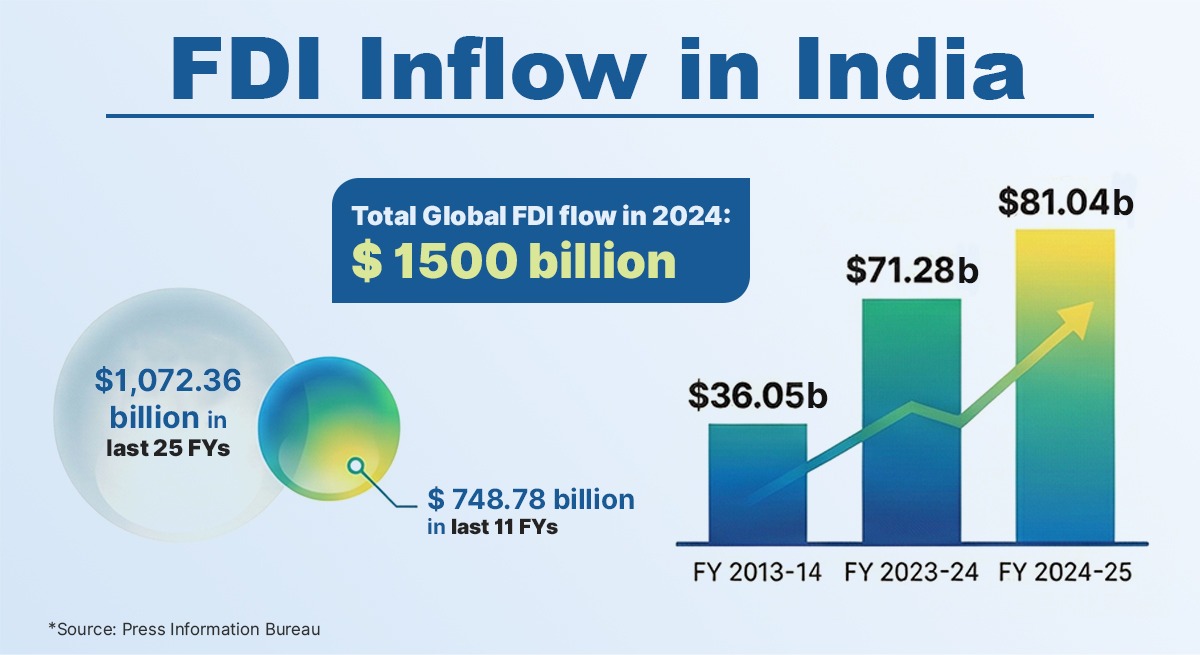

In fact, as far as manufacturing FDI is concerned, China and India were not far apart in 2024-25. India attracted manufacturing FDI of $ 19.04 billion as against $ 30 billion by China. Considering that many western factories in China are legacy institutions and require new infusion of funds, the actual FDI attracted by both countries for manufacturing may be nearly the same.

As the West became wary of China’s leveraging of its economic muscle to achieve strategic goals of territorial advancement and enlarging its influence in the Global Commons, India had an offer hard to beat – its usefulness as a counter to China. The Buy One, Get One free approach saw Spain acceding to the India-helmed Indo-Pacific Oceans Initiative (IPOI) which seeks to increase cooperation for a free, open, and sustainable Indo-Pacific. This is an area where heightened Chinese domination is the prime nightmare for western countries. It is, of course, a source of perennial unease for India.

India’s FDI requirement, like that of China in the past, is huge in order to make a bigger dent in the world market. 15 years back, then Prime Minister Manmohan Singh had pegged the cost of modernising India’s infrastructure at $ 1 trillion. This is now considerably enhanced though figures are hard to come by.

Both the Indo-US trade deal and the India-EU FTA will take time to mature. But they will soon lead to what is known as the ‘snowball effect.’ “(The Indo-US trade deal) undoubtedly changes the picture on capital flows. This was the biggest stumbling block for capital flows. This makes a huge, huge difference,” noted India’s Chief Economic Advisor (CEA) V. Anantha Nageswaran, to the Indian Express, minutes after the trade deal’s announcement close to midnight on February 2, 2026.

But the CEA’s observation that the deal restores momentum to the “China+1″ strategy may have to wait till other efforts fructify. The lack of a deal had put Portfolio FDI investors on the edge. In the recent past, they had pulled out $ 12 billion from Indian markets.

Indian diplomacy and the PMO have been in an overdrive since late last year, which closed with the announcement of the India-New Zealand FTA. Since then, most of the itineraries of Prime Minister Narendra Modi and External Affairs Minister S Jaishankar point in this direction. In the same period, major money bags and high-tech incubators have found a warm welcome in India.

The dust raised by the FTA with EU and the trade deal with the US tends to obscure equally significant attempts to channelise FDI into India. One was the unprecedented two-hour dash to India at short notice by the President of UAE, Sheikh Mohamed bin Zayed Al Nahyan (MBZ), accompanied by almost his entire Cabinet. MBZ’s focus was on security following the defence pact between Pakistan and Saudi Arabia, with which UAE has developed a serious rift.

However, MBZ came with a slew of economic offers. A joint statement after his visit promised UAE investments in key strategic infrastructure, including an airport, a pilot training school, a new port, a smart urban township, railway connectivity, and energy infrastructure. The UAE has also promised to invest in the Second India Infrastructure Fund scheduled for launch in 2026.

As the gap between China and India in attracting FDI narrows, one common aspect about India’s interactions with most of the countries has been its offer to be a bulwark of stability and a rules-based order in the region. This is a comfort that China cannot offer since it is in an adversarial security relationship with the US and its well-heeled allies and proxies. The “China Plus One’’ approach may take time to give returns but the Indian government is moving full speed ahead with its efforts.

Disclaimer: The views expressed in this article belong solely to the author and do not reflect the views or opinions of DNN24 or any affiliated organization.

Also Read: From tariffs to trade: A reset of India-US ties

You can connect with DNN24 on Facebook, Twitter, and Instagram and subscribe to our YouTube channel.